Salary Sacrifice with

Payroll Pay®

Managing a monthly budget can be challenging, especially during a cost-of-living crisis

That’s why Vivup’s Payroll Pay® salary sacrifice scheme helps to support your staff when they need it most

Whether it's budgeting for essentials, covering an appliance breakdown or easing the pressure of Christmas, Payroll Pay® lets your people spread the cost straight from their salary, making their financial lives more manageable

What is Payroll Pay®?

Payroll Pay® is a salary sacrifice scheme enabling staff to spread the cost of the items they want and need over an agreed period via fixed monthly salary reductions. These reductions are taken from your employees’ salary before it reaches their bank account, helping them enjoy more of what life has to offer with less financial worry

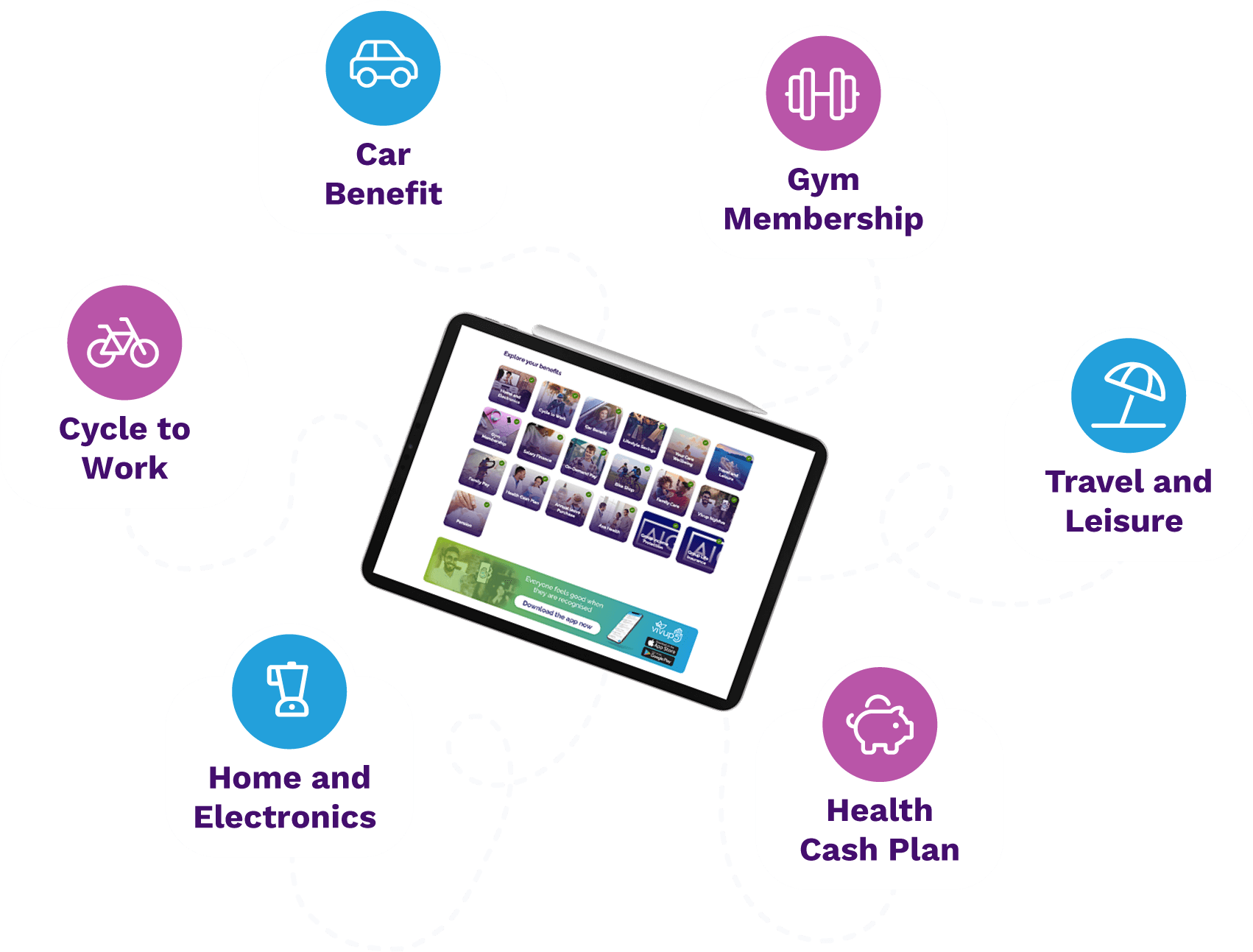

Wide range of products available from trusted retailers

Detailed reporting features including organisational savings

Spread payments on essential items to help combat the cost of living

The Payroll Pay® benefits

The Payroll Pay® benefits

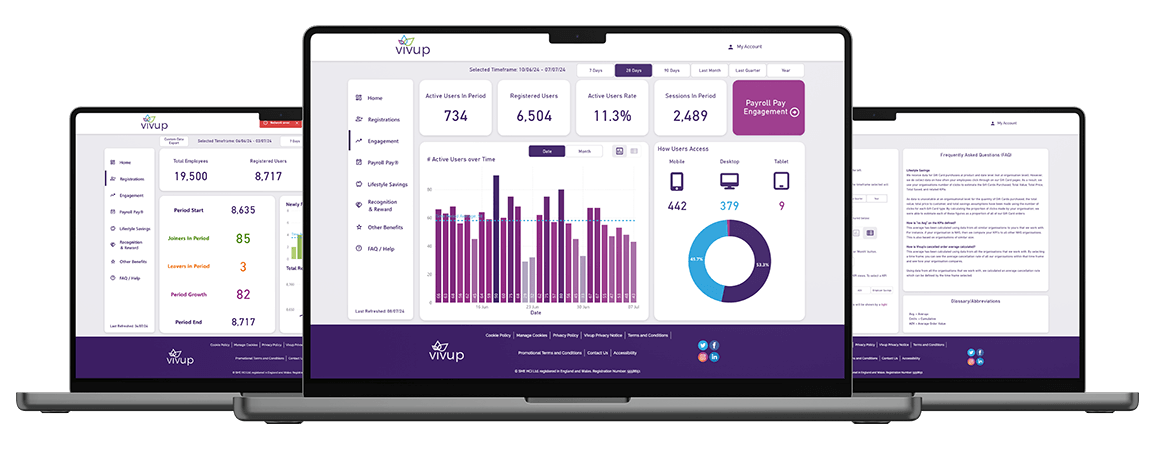

Measure the Impact of Payroll Pay®

Unlock powerful insights into your Payroll Pay® benefits with data on orders, spending, usage, engagement and organisational savings. Measure impact, track success and see how Payroll Pay® supports both your people and your business at a glance

"Vivup has been instrumental in helping us introduce fantastic benefits on an attractive and vibrant platform that also offers our colleagues a user-friendly app, too!"

Bradford Council

"We have been delighted by the engagement with our new employee benefits platform. In the first month alone, we had well over 1,000 staff registrations. Vivup has been fantastic in their support of the launch and the programme"

Warwickshire County Council

“Home and Electronics remains a core part of our employee benefits programme and continues to deliver significant savings for Lancashire & South Cumbria NHS Foundation Trust”

Lancashire & South Cumbria NHS Foundation Trust

Frequently Asked Questions

Who is eligible for Salary Sacrifice?

A salary sacrifice arrangement must not reduce an employee’s cash earnings below the National Minimum Wage (NMW) rates. Employers must put procedures in place to cap salary sacrifice deduction and ensure NMW rates are maintained (or National Living Wage if preferred).

It may be necessary to change the terms of a salary sacrifice arrangement where a lifestyle change significantly alters an employee’s financial circumstances i.e. where a reduction in salary takes the employee below National Living/Minimum Wage or below the level of any statutory payments to which the employee are entitled (for example Statutory Maternity Pay, Statutory Adoption Pay, etc).

In this case, then the employee’s eligibility to continue in the scheme will cease, but they will still be responsible for meeting the cost of the goods.

What are the tax implications?

By sacrificing a portion of their salary, the employee reduces their taxable income which can result in tax savings. Employers can save on NICs when their employees participate in salary sacrifice schemes. This is because the employee salary is reduced which means that both the employee and the employer NICs are reduced

The impact on tax and National Insurance contributions payable for any employee will depend on the employee’s salary and the type of salary sacrifice arrangement.

If the salary sacrifice arrangement includes taxable benefits the employer must report the value of those benefits on the employees P11D form which is used to report expenses on benefits to HMRC.

Employers must also ensure that the employee’s salary after the sacrifice does not fall below the national minimum wage. This is because the NMW is based on the employee’s gross salary, not their net salary, after the sacrifice.

Vivup are fully compliant, and for the past 15 years, our benefits have been developed in accordance with HMRC regulations and all relevant legislation and government standards, with all procedures aligned with current best practice in the industry.

What do I (the employer) have to do?

Our Implementation Team and your assigned client success manager will take you through the onboarding process and go over order authorisations. We also have handy guides and FAQ resources.

It’s really quite simple - within the employer side of the portal, your chosen administrator will receive automated reminders to advise there are orders pending approval. They can then select the Order Management tab and all salary sacrifice benefit orders will be shown in this section. They select pending orders to view and approve/decline:

They can then follow the checking process:

- Basic details - employee name, employee number, NI number and address match those held on the organisations’ system

- Order detail - what the employee has ordered, what the monthly reductions will be, and should the organisation have a limit, you can ensure the employee does not go over that limit

- National minimum wage/living wage check - the built-in calculator and will either flag up as “red” (falls below NMW) or “Green” (minimum wage criteria met).

Once the order has been accepted, Vivup will place the order.

At the end of each month, the Vivup finance team will issue a payroll report to the organisation, so that reductions can be scheduled, (i.e. if a bike is ordered on the 11th January, a payroll report is sent to the organisation on or around the 4th February, and the first reductions will be taken from the employee’s February pay).

How do employees sign up/create an order?

Employees will be alerted by email to the launch of their new benefits platform which will contain a secure link to set up their new account. They simply click on the link and complete the registration details – this also allows them to switch from a work to a personal email address and to set up a secure password.

We also have a group registration process which can be used for the entire organisation. Once set up, this has the benefit of being an ongoing enrolment tool which requires minimal management or resourcing from a client perspective.

To create an order, employees simply select the item they want and input their details for verification and delivery. Once the order is placed, it is sent directly to your payroll team for approval. The employee will receive a confirmation email and further details around delivery from the supplier.

What happens if an employee leaves?

If an employee leaves the organisation with a remaining balance, the liability sits with the employer.

To reduce risk for the employer we suggest:

- Establishing eligibility criteria to mitigate risk/liability

- Forward planning around:

- taking any remaining balance from the employee’s final salary as per contractual agreement

- or invoicing the former employee directly (within the agreement)

The employer can also include an income generation of 3-5% on every order, which could be used to cover any debts from a ‘bad leaver’.

It is important that employees fully understand the terms and conditions of any salary sacrifice arrangement before agreeing to participate.

How do you ensure your prices are competitive/up-to-date?

Employees browse and order directly within our portal. Our automated range shows all products that Currys and John Lewis have in stock and dynamically updates the price and range as things change. Once an order is placed the price is ‘locked’ so can’t go up and stock is held by Currys or John Lewis, enabling the authorised personnel to approve the order without the risk of stock running out or prices changing. Vivup are the only benefits provider able to offer a fully automated solution via Currys or John Lewis. Our online platform host automated feeds from both Evans Cycles and Cycle Solutions.

We adopt a proactive approach to the benchmarking of services and goods provided through our benefits and, due to our unique business model, we do our best to ensure that our costings are better than or competitive with other providers in the market. Our key differentiator is that we do not charge set up fees or management fees for employers ensuring that access and roll out to the Vivup platform is zero cost for the employer.<

What if something goes wrong with the order/who is responsible for customer service?

Employees looking for support have access to our in-house customer service facility through email, phone, and live chat, clearly available to employees through links and banners on our platform. Our telephone help desk operates Monday to Friday 8.00am to 6.00pm. Our webchat and email support are available Monday to Friday 8.00am to 6.00pm and Saturday and Sunday 10.00am – 2.00pm.

All queries from employees are dealt with by Vivup directly and we will liaise with any third-parties where relevant. Customers are kept up to date with the issue and in the case of an order rejection, we have an order retention team to help employees find alternative items or direct them to the relevant lifestyle savings.

Start improving your employee wellbeing today

To find out more about how Vivup can benefit your business, request a demo to get started today