Health Cash Plan Benefit

Essential Heath Care, Covered

A Health Cash Plan for employees helps alleviate the anxieties that healthcare costs cause. Offering a Health Cash Plan employee benefit fosters a supportive work environment and can demonstrate your commitment to employee wellbeing

What is a Health Cash Plan?

Health Cash Plans (also called Health Cash Back Plans) are a way for employees to cover medical expenses like prescriptions, dental care, eye tests, and physiotherapy for a reduced monthly fee. They support organisations to give peace of mind for those employees who are struggling with additional medical expenses, whether for themselves or for their partner and dependent children

Create A Healthier Workforce

Reduce absenteeism and help employees stay fit with access to financially manageable treatment pathways

Support Working Families

Help to enhance your appeal as an employer by offering an inclusive benefit that covers pre-existing medical conditions

Promote Productivity

Reduce impact to productivity caused by illness with coverage for a wide range of treatments

How Does a Health Care Cash Plan Benefit Employers?

- Demonstrates employee health is a business priority

- Supports employee retention and satisfaction

- Enhances your financial wellbeing offering

- Helps to reduce absenteeism

- Makes vital healthcare more manageable

What are the Benefits of Health Cash Plans for Employees?

The benefits for your people:

- Makes healthcare costs more manageable

- Supports physical and financial wellbeing

- Option to cover a partner or unlimited dependent children

- Wide range of treatments available including optical, dental, chiropractic, acupuncture, mammography and more

How Does Our Health Cash Plan Work?

From day one, our Health Cash Plan offers 100% reimbursement for most common treatments within a set, annual allowance.

Our plan allows for an unlimited amount of dependent children to be added at no additional cost, and does not discriminate based on pre-existing medical conditions

Our Health Cash Plan Coverage

Our Health Cash Plan covers:

- Dental care and dental trauma

- Optician’s costs, including: sight tests, glasses and contact lenses

- Professional therapy, such as physiotherapy, osteotherapy, and acupuncture

- Hospital stays, NHS prescription charges, and more

“In only a short space of time, by focusing on employee benefits and being an attractive employer, we have made great strides in attracting the diverse, ambitious, and skilled workforce that we know we need to weather the current storms”

Wilson James

Health Cash Plan - Frequently Asked Questions

What's the difference between a Health Cash Plan and health insurance?

Health insurance is generally set up to cover people when unexpected medical costs arise. This is different from a Health Cash Plan, which is set up to help pay for routine medical expenses like prescriptions, eye care, and dental treatments. In fact, you can even have both an employer Health Cash Plan and your own private health insurance at the same time

Another key difference is that Health Cash Plan providers will work alongside the NHS to cover the costs of prescriptions, eye tests, and dental treatment, whereas many health insurance options might require you to go to private hospitals or dentists

Who is eligible for a plan?

This depends on the business Health Cash Plan that an organisation chooses to run. Vivup has two options that an organisation can choose from: a personal plan or a family plan. Our personal plan covers employees and their dependent children, while our family plan also allows them to include their partner’s coverage as well

How do pre-existing medical conditions affect eligibility?

Pre-existing medical conditions do not affect a person’s eligibility, as our Health Cash Plan covers all pre-existing medical conditions

Can I add my partner and children to my Health Cash Plan?

Yes, our Health Cash Plans already allow for an unlimited number of dependent children to be added to the plan, and partners can be included as well through our family plan option

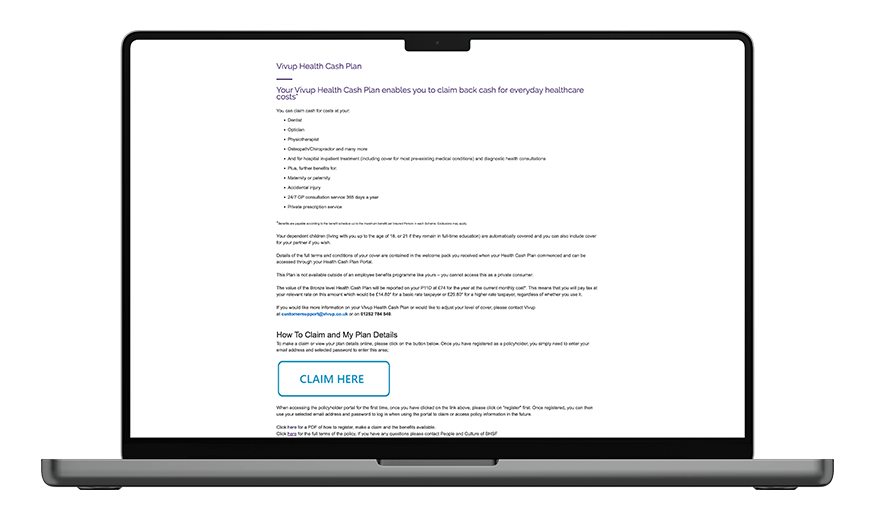

When and how can you make a claim?

There are three core steps to making a claim through our Health Cash Plan benefit:

- The employee attends an appointment or pays for a prescription and keeps their receipt

- The employee completes the claim form and uploads a scan or a photo of the receipt within the Vivup portal

- The payment will normally be made directly into the employee’s bank account within 72 hours, unless documentation is incomplete and further steps are needed

*Exclusions may apply. Vivup Financial Services Ltd (trading as Vivup), 3 Dorset Rise, London, England EC4Y 8EN, is regulated by the Financial Conduct Authority (Ref 598106). UK Only. 18+ subject to status. Terms apply. The Health Cash Plan is provided by BHSF Limited.